I love watching the Olympics: it’s thrilling to watch athletes who’ve devoted years of their lives to a sport compete on the world stage.

At the same time, I can’t help but wonder: are they actually the best?

How do we know the world’s fastest runner isn’t clocking in five minutes late for her shift at Chipotle right now? Isn’t it possible that the best freestyle swimmer has failed to reach his full potential because his tutoring and dog walking jobs take up so much of his free time?

Most talent goes untapped. Unrecognized.

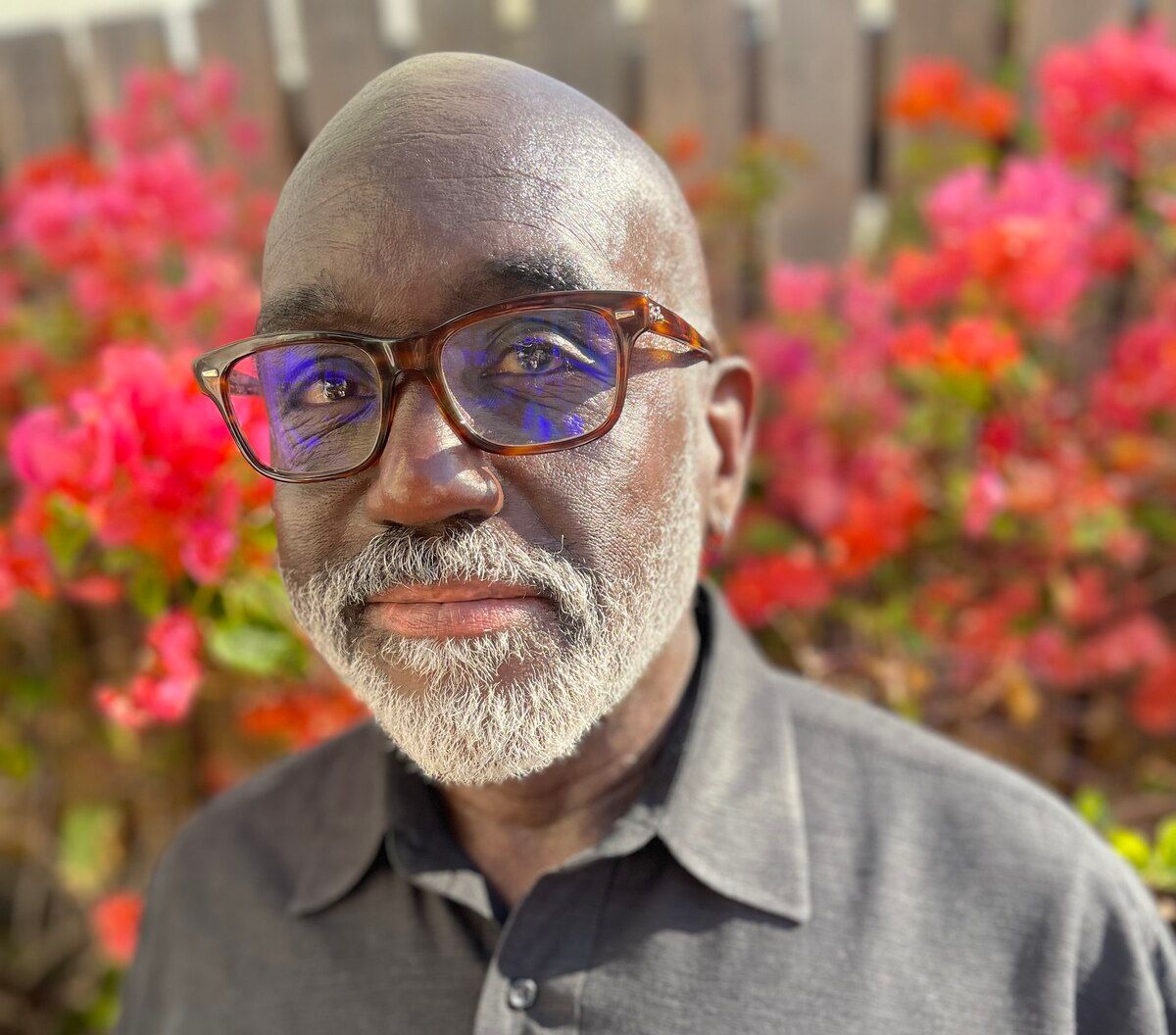

Originally from Spain, Laura González-Estéfani founded a startup in the early 2000s that led her to growth roles at eBay and Facebook in Silicon Valley. In 2016, she moved to Miami to found TheVentureCity, an early-stage VC firm that seeks out entrepreneurs working outside major tech hubs in emerging ecosystems.

“I met a lot of people like me that came from Spain, but I see Sweden, Nigeria, Venezuela, so many extraordinary places that have bred extraordinary talent in engineering and product and so many different things, and somehow they were not getting their opportunities in the places where they were from,” she said in our May 2024 interview.

“I was like, ‘what if we would be able to invest in these amazing brains around the world without needing them to leave home?’”

Based in Miami, TheVentureCity is more centrally-located than Palo Alto’s legacy VC firms. “It is six hours away from London, five hours away from San Francisco, and eight hours away from Sao Paulo,” said Laura.

Portfolio companies are spread across sectors like life science and health, fintech, proptech, agriculture, and hospitality/travel. “I am very fascinated by unsexy, old, not-disrupted-yet industries,” she said. “Our checks range from $2 - $4 million. Depending on the business, we like to lead Series A.”

Our interview touched on a number of topics, including her view that hard-working founders (and early employees) “need to be more liquid” without taking “a 50 percent haircut” in the secondary markets.

With a slower cadence in the IPO market, LPs are eager for returns, but so are the scrappy teams who’ve spent years running lean while generating value. “They deserve to be able to pay for their mortgages, at least,” said Laura.

She also talked about where she’s looking to invest, how she prefers to be pitched, and what happens before and after she takes a discovery meeting with a founder.

“I am a huge fan of going for lunch with a founder. I would ask about your vision, your passion, your team,” said Laura. “Are you a talent maximizer? Would I work for this guy or this lady?”

Runtime: 45:01

EPISODE BREAKDOWN

(2:00) Laura describes her journey from startup founder to VC.

(6:42) The upsides (and many downsides) of today’s secondary market.

(8:19) “When I was in the Bay Area, I realized that talent has no ZIP code.”

(12:43) “Silicon Valley is an amazing place where people think big and limitless. It's an amazing experience to be there — for a few months.”

(16:24) Sectors where TheVentureCity is looking for investment opportunities.

(20:36) “Our checks range from $2-4 million. Depending on the business, we like to lead Series A.”

(22:27) What happens during (and after) she takes a founder discovery meeting.

(28:25) “I believe that founders choose the capital, not the capital chooses the founders.”

(30:27) Why Laura and her team enjoy solving “big hot potato” problems.

(36:19) “You have to have questions. Because if you don't have questions, I'm not investing in you.”

(37:34) Several red flags that signal a founder isn’t ready to work with a VC.

(39:22) Ego-driven tech founders vs. media perception.

(43:08) Why a-holes are “hard to detect at first,” and how she handles them after making a positive ID.

LINKS

SUBSCRIBE

Thanks for listening!

— Walter.