Back in the day, San Francisco’s Ferry Building was the final stop on a cross-country journey. Almost every movie set here includes one shot of the structure: built in 1898, it has a tall clock tower and big red letters that spell out “Port of San Francisco.”

Travelers could board a train in Manhattan on Monday and arrive in Oakland, California on Thursday or Friday. From there, they’d take a ferry across the Bay, ending their trip at the foot of Market Street in downtown SF.

The Jet Age put an end to that: today, it’s a commuter hub with shops, restaurants and even a weekly farmers’ market.

But for some startup founders, the Ferry Building is still a place where one journey ends and another begins — it’s also home to the offices of CapitalG, Alphabet’s growth-stage VC fund.

Capital G focuses on startups that have achieved product-market fit, making investments that range from $50 to $200 million per company. Its portfolio includes Airbnb, Stripe, Credit Karma, Duoliongo and Magic.

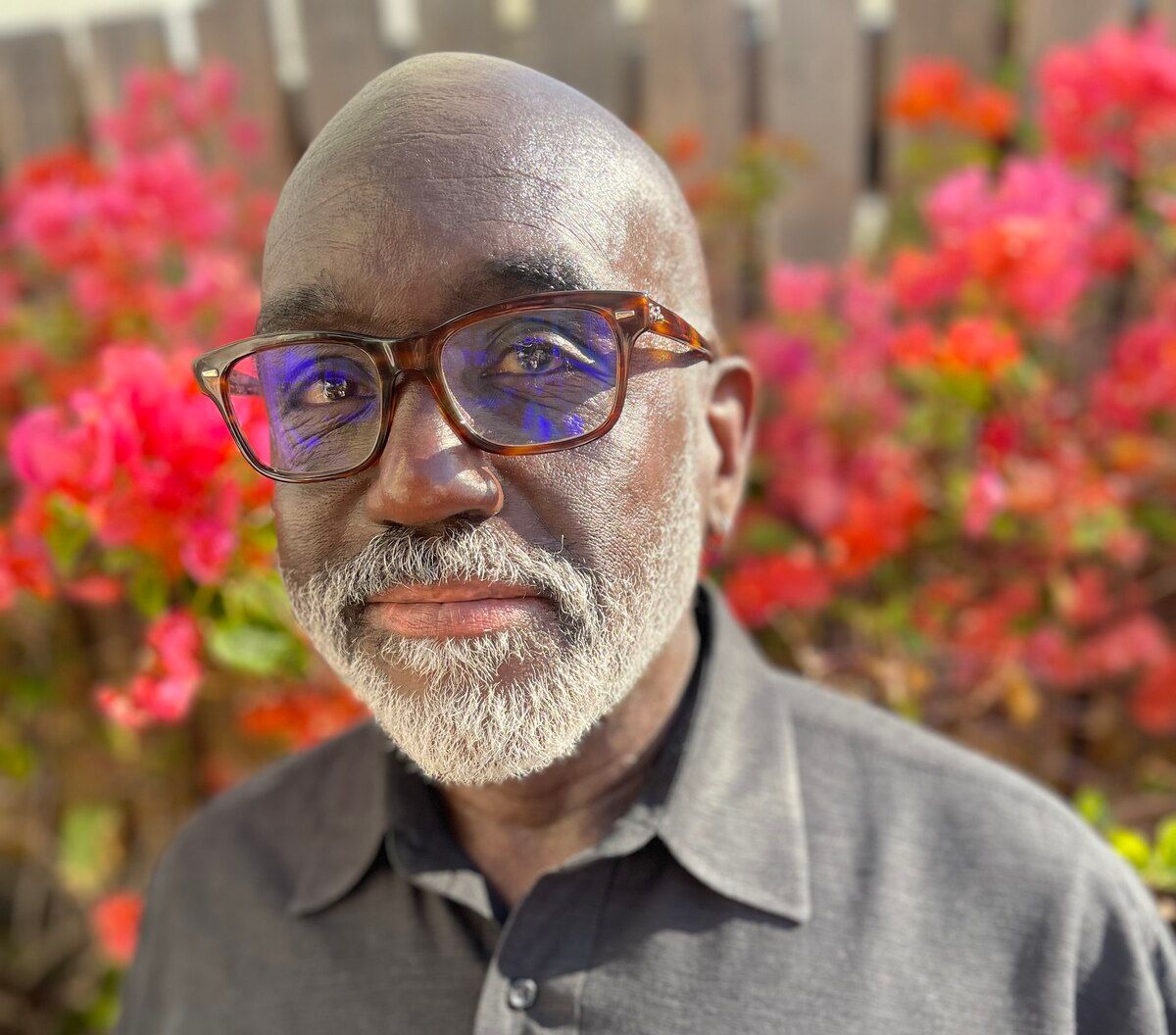

In July 2024, I sat down with CapitalG partners Jill (Greenberg) Chase and James Luo to learn about the key signals indicating a company is ready for growth-stage investment, how they leverage resources from Google and Alphabet to support portfolio companies, and the frameworks they’ve developed for assessing risk and potential returns.

“No matter what stage we're looking at, there's always a little bit of the dream of what it could eventually be,” said Jill. “Could this company be a $100 billion company? Could it be a trillion-dollar company?”

They also dove into the importance of go-to-market strategies, team-building, and product partnerships.

Whether you’re an early-stage founder or curious about what it takes to scale a business to the next level, this conversation offers actionable insights into navigating growth-stage funding.

Runtime: 53:05

EPISODE BREAKDOWN

(1:57) A general overview of CapitalG and its relationship to Alphabet and Google.

(6:11) What are some of the early signals indicating that a company has reached growth stage?

(8:33) James: “When you get to the later stages, you have a ton of different data points that you don't have at the Series B.”

(12:53) Jill: “We talk a lot about the concept of, ‘are you paid for the risk that you're taking?’”

(18:53) Jill: “Our job when things aren't going so well is to remind them of the dream and to say, ‘no, we're not giving up.’”

(19:30) Which trends and technology Jill and James are following these days.

(25:25) The framework James uses to size TAM for growth-stage startups.

(30:50) James: “TAM is a judgment call. It's as much art as it is science.”

(32:28) Jill on what separates a high-potential AI startup from the rest of the pack.

(38:29) Jill: “The way we approach investing at CapitalG is highly thematic and sort of thesis-driven.”

(44:50) Why growth-stage investing is similar to park rangers looking for forest fires.

(48:45) James: “You're basically never going to find somebody who's amazing at every possible thing that you need to do to run a business.”

(51:01) Jill: “It is a huge red flag for me when somebody can't say, ‘yep, I was wrong about this.’”

LINKS

Subscribe to Fund/Build/Scale

Thanks for listening!

– Walter.