Caring for the people we love is a joy and a duty — but in America, it can also come at a steep price.

According to a recent study, having two kids in child care costs more than a typical mortgage payment. Every day, 10,000 Americans turn 65, raising the stakes for their financial security, health care and housing. Caught in the middle: members of the Sandwich Generation — middle-aged people who are raising children while caring for their aging parents.

Based in New York, Elana Berkowitz and Courtney Leimkuhler are co-founders and managing partners at Springbank. An early–stage firm, they focus on underfunded and under-innovated sectors that support working women and their families, largely in three key areas: the future of work, the care economy, and household consumer services.

Typically, Springbank invests anywhere from $250,000 to $1 million in pre-seed to Series A companies. Their thesis is driven by growing demand from employers, insurers, and the government, recognizing the economic impact of caregiving, which includes fields like teaching, child care, nursing and home health care.

Portfolio companies include Aloe Care Health, which makes a medical alert and mobile companion that connects caregivers to patients, and Carefull, a financial safety tool for seniors, a preferred demographic group for fraudsters and scam artists.

“We look at the infrastructure to serve the needs of working women and their families as something that's underfunded, under-innovated, and kind of a huge opportunity hiding in plain sight,” said Elana.

We talked about backing solutions that combine business acumen with empathy for care workers while considering ethical AI use. They also shared insights on how to pitch effectively, stressing the importance of addressing the 'how' alongside the opportunity size.

Ultimately, Courtney said Springbank is looking for founders who understand their business model inside out:

“Whose pain is it, and does that person have the money to pay for it? If not, who else is motivated to pay for it? How are you going to sell through the channel, and why are you uniquely positioned to do it?”

Runtime: 39:53

EPISODE BREAKDOWN

(1:21) Courtney and Elana share Springbank VC’s origin story.

(4:03) Their investment thesis: the care economy, future of work, household services.

(7:01) Why their investment in Carefull “is really levered to this concept of financial caregiving.”

(11:23) How they recognize founder-market fit.

(15:29) Which types of founders are they most interested in working with?

(18:01) Assessing the ethical implications of AI applications on caregiving.

(20:48) “The hardest decisions these founders might encounter might be many years after our capital has been put in.”

(23:36) Unsolved problems Courtney “would love to see” more founders focus on.

(28:23) Common misperceptions about AI and the care economy.

(30:43) Elana: “One area that we're interested in is memory care: Alheimer’s, dementia.”

(33:31) How to pitch Springbank VC.

(35:52) Tactical and strategic advice for first-time founders working on pitch decks.

(38:02) Elana: “I always really love when it is clear to me that founders have profound empathy.”

LINKS

Subscribe to Fund/Build/Scale

Thanks for listening!

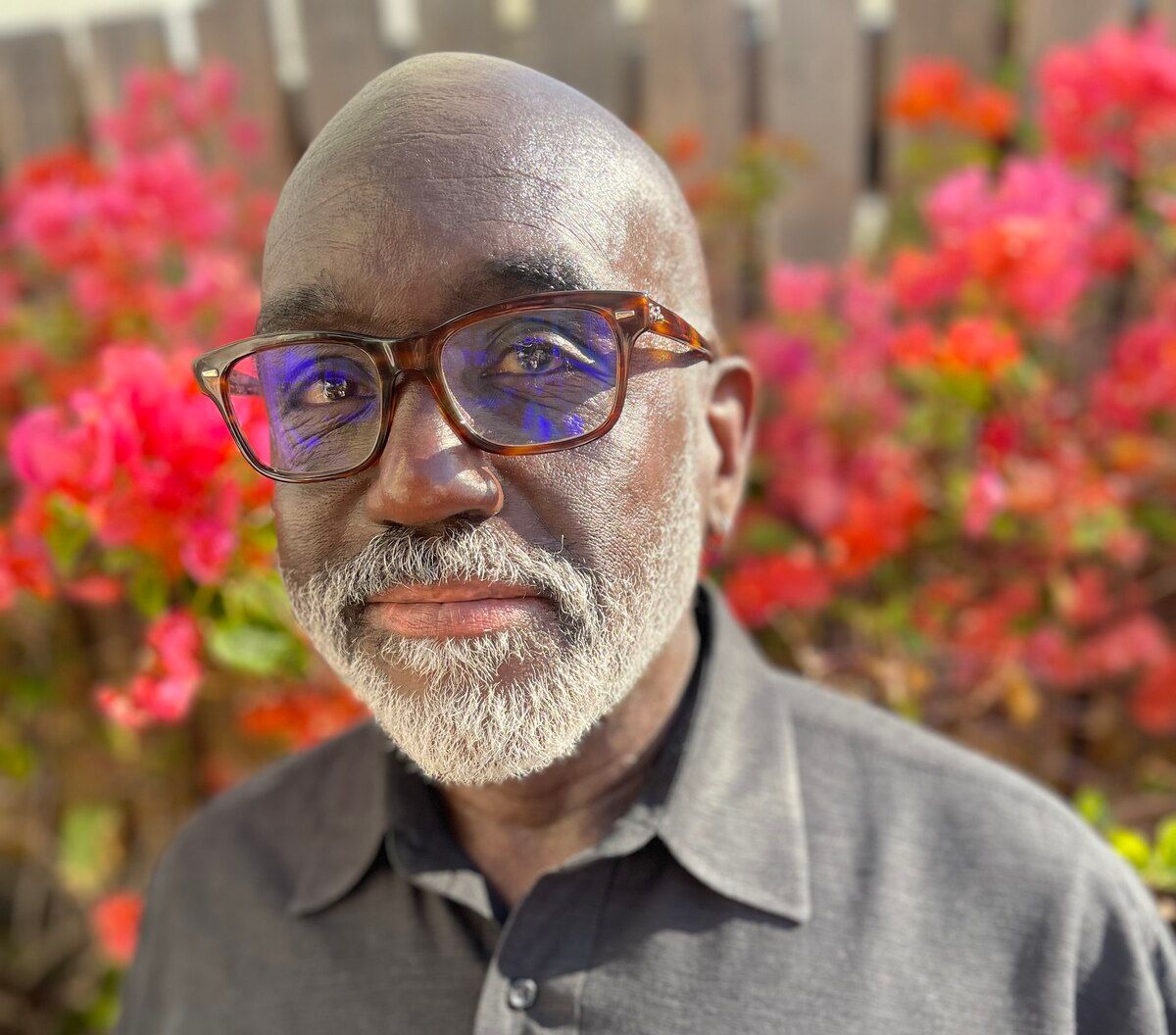

— Walter.