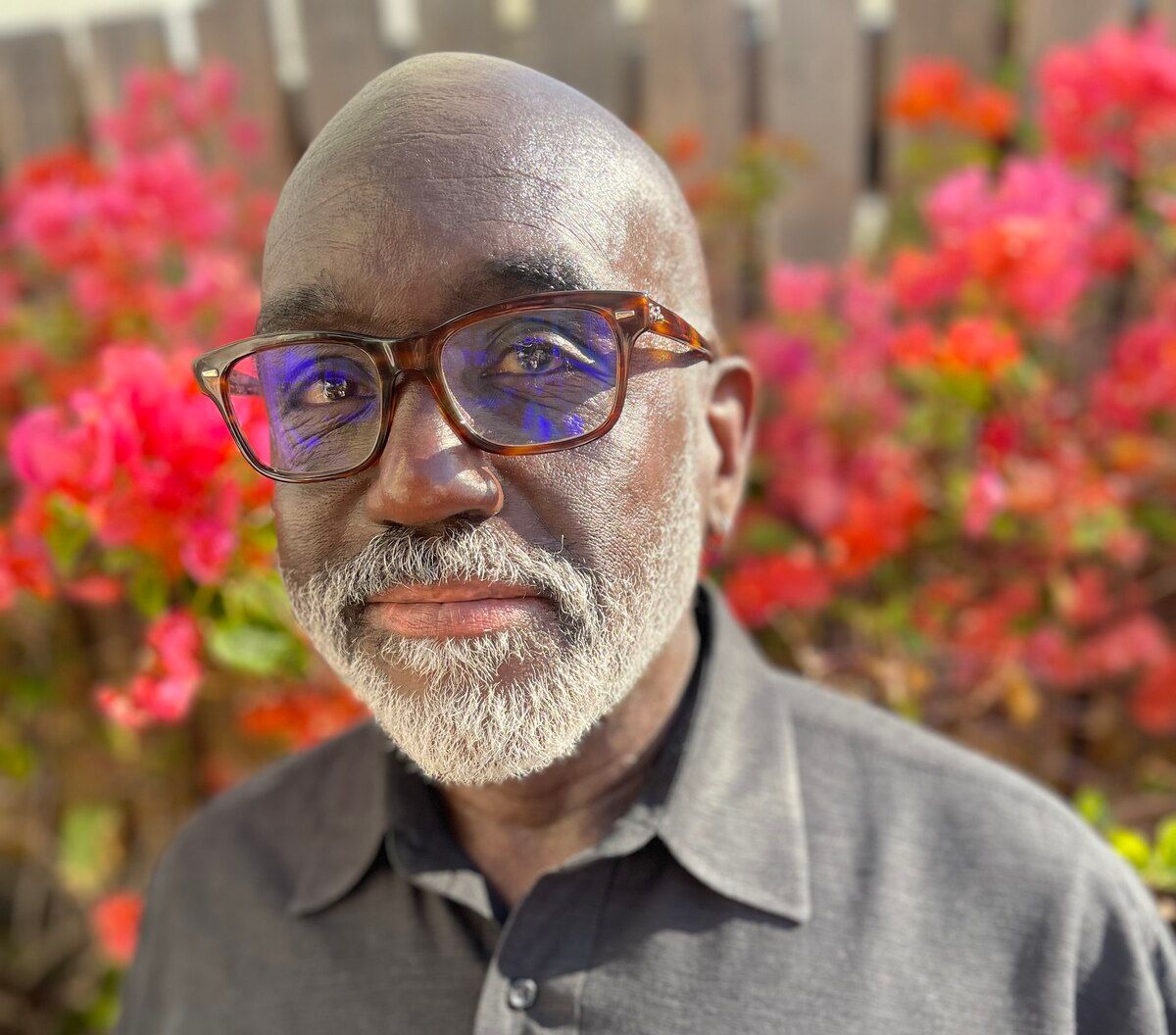

If a startup has no product, no customers, and no revenue, what exactly are seed-stage investors betting on? According to Nnamdi Iregbulem of Lightspeed Venture Partners, the answer lies in human capital.

He recently explored this in his essay, Seed Valuations Aren’t Valuations, where he argues that seed-stage valuations primarily reflect the opportunity cost of the founding team, particularly in a market where technical talent is increasingly expensive.

Founders, many of whom are leaving high-paying jobs to launch startups, anchor valuations based on the minimum capital required to justify their own career risks. This human capital framing explains why seed valuations remain relatively stable, even amidst macroeconomic shifts.

To dive deeper, I invited Nnamdi on Fund/Build/Scale. We talked about how his thesis applies to today’s AI startups, where the rising costs of GPUs and the scarcity of top AI talent are pushing valuations higher.

Whether or not you’re a founder, this episode will help you get a sense of your value in the tech ecosystem. There was a time when a senior engineering role at Meta or Apple was enough to impress early-stage investors. Not anymore, says Nnamdi.

“ Coming from a large and stable big tech company is not the positive signal that it used to be,” he said. Education and work history are still “salient brand indicators,” but they’ve also become “inflated in terms of how people tend to evaluate these things and what they infer from there.”

Instead of using LinkedIn resumes to filter pitches, he’s looking for “someone who’s demonstrated excellence in their field,” like an innovative software engineer or a talented sales lead. “These other things are mostly our proxies at best,” he said. “And I think their value as proxies has declined over time, to be honest.”

And if you’re worried about talking to investors too early, let that go.

“A lot of the pitches I get are basically two people, a PowerPoint deck, and their dog,” said Nnamdi. “ I really like the early stages where you have to take something that is barely a scribble on a piece of paper and kind of dream it into what it could be over time.”

RUNTIME 33:24

EPISODE BREAKDOWN

(2:24) “ I was the first-born son of two Nigerian immigrants who really badly wanted me to be a doctor.”

(6:17) “ I was sort of like, ‘what do I know about early-stage companies?’ I never worked in a startup.”

(8:50) The day-to-day work Nnamdi does with the founders in Lightspeed’s portfolio.

(11:13) He explains why seed valuations aren’t valuations.

(13:31) “ The only characteristic… that had any real predictive value was the opportunity cost of the founder.”

(16:43) “ Coming from a large and stable big tech company is not the positive signal that it used to be.”

(17:32) The weights and measures he uses to assess seed-stage founders.

(19:33) When domain expertise is (and is not) useful.

(20:53) How he evaluates technical vs. non-technical founders.

(24:16) “A lot of the pitches that I get are basically two people, a PowerPoint deck, and their dog.”

(25:18) How to pitch Nnamdi directly.

(26:21) Setting valuations is “ more driven by the founders than it is by us.”

(29:33) His advice for anyone who wants to break into venture capital.

LINKS

SUBSCRIBE

Thanks for listening!

– Walter.