I am not comfortable making predictions. If I spoke to more people or did more in-depth research, maybe I’d feel more confident about forecasting the future.

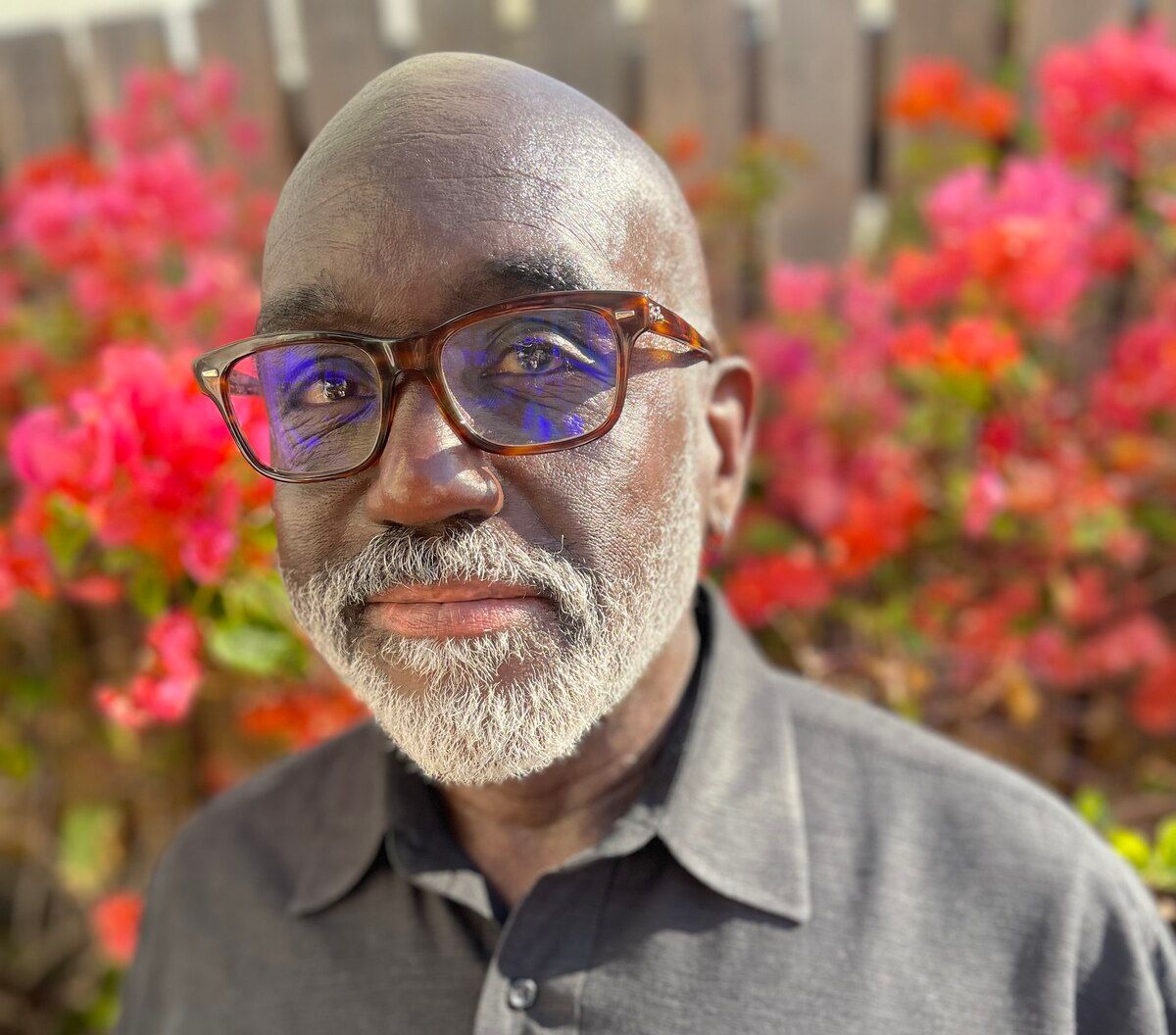

Sri Chandrasekar, Managing Partner at Point72 Ventures, on the other hand, has a pretty broad perspective: He takes around 300 first-call meetings with founders annually, and his Seattle-based team handles around 2,000 such meetings across the whole team, as he shared during our interview in July 2024.

We met in a noisy WeWork space in San Francisco for an extended discussion about his investment thesis and the types of opportunities he's targeting, Sri also offered key insights into the current early-stage fundraising environment.

“It is simultaneously the easiest it's ever been to raise a seed round that I've ever seen in my life, because you can build a cool little product and show some value,” he said.

“And the hardest that's ever been, in my opinion, to raise a Series A. It's become extraordinarily easy to build an initial product, go raise a couple million bucks and get off to the races. But I think that investors that are looking at the Series A are like, ‘wait, you're one of 19 companies that's pitched me this exact same thing in the last three months.’”

Because VCs are sifting through piles of AI pitches these days, he said it’s even more important for founders to dig deep moats and clearly articulate their value potential.

“A company coming to me and delivering something that's 5 percent better, that's not interesting,” noted Sri. “My expectation if I'm going to pay money for it, is that they're building something five times better than something I can build for myself.”

He also spoke about the growing difficulty for startups seeking Series A funding, contrasting it with the relative ease of raising seed rounds. Investors are aware that AI-related startups need more capital than ever to launch a MVP, leading to larger seed rounds without increasing dilution for founders.

However, this drives up valuations, and when startups reach the Series A stage, investors hesitate to pay such high prices for companies with limited traction.

“I think a lot of seed-stage founders are going to see this in the next year or two,” said Sri. “They're going to raise a Series A and they're going to be not up rounds, they'll be flat rounds.”

42:21 minutes

Episode breakdown

(1:45) “In-Q-Tel is the best place in the world to learn about venture.”

(3:53) “Machine learning and AI is gonna be the most transformative force to our economy since the steam engine.”

(8:55) “I think we're six to twelve months away from the trough of disillusionment.”

(11:52) “It's easier than ever to build a prototype of anything… and the hardest that's ever been, in my opinion, to raise a Series A.”

(15:27) The differences between working with technical and non-technical founders

(19:23) “I'm starting to think that Herman Miller Aeron chairs probably hold their value longer than GPUs.”

(21:16) “Returns are getting compressed, and something's got to give, right?”

(24:21) What real repeatability actually looks like.

(27:33) “It's really important to not get ahead of yourself in terms of marketing and branding until you have clarity around, ‘do I have product-market-fit?’”

(31:26) Sri breaks down the “triple-triple-double-double-double” growth framework.

(34:39) Advice for founders who need help de-risking themselves.

(37:43) “I don’t know what the point of being in stealth is.”

(40:47) What would Sri ask an early-stage CEO if he were interviewing for a job?

Links

Subscribe to Fund/Build/Scale

Thanks for listening!

– Walter.