If a tree falls in the forest, and no one is around to hear it, does it make a sound?

If a founder would rather turn to a podcast like mine for operational advice instead of the investor who led their round, is that VC really adding value?

According to a recent survey conducted by Mercury, the fintech that provides banking services to startups:

55.7% of founders talk to their peers when they need startup advice;

51.6% get support from their broader startup communities;

37% of them sought advice from podcasts;

VCs were their preferred go-to just 20.3% of the time.

I unpacked those and other findings from the survey with Mallory Contois, Mercury’s head of community and leader of Mercury Raise, their founder success platform. In our conversation, she shares her insights about how the early-stage founders she works with navigate challenges like fundraising, hiring, and customer acquisition as we head into 2025.

“AI investments now are a lot more calculated than they were in the last couple of years.”

— Mallory Contois, Head of Community, Mercury

She also explains the unique psychology that makes it hard for founders to admit uncertainty to their investors: entrepreneurs are expected to project confidence, but asking a business partner for help can make a person feel vulnerable.

“ Founders do still go to investors for intros and for connections of that sort,” said Mallory. “Where we sort of start to really disconnect is when investors promise operational value-add. A lot of VCs are really excellent past operators and they've seen a ton of companies, and they have a lot of value to add.

The problem is the psychology of the founder, which is that it's important that they keep the trust and the positivity of their investors because they want them to invest in their next round.”

Mallory noted that generative AI tools are helping teams stay leaner for longer periods, which may be one reason why “we're seeing founders and investors giving the advice to be much more constrained in spend management” compared to previous eras. When it comes to hiring, she said founders are hiring generalists in greater numbers, using specialists as fractional employees or contractors so they can stretch out their runway. “Those generalists, plus the AI tools, can really get so much done now.”

Interestingly, Mallory said there’s also a vibe shift away from perceiving solo founders as risky bets: “I personally would much rather see someone as a solo founder who's brought in a couple of senior leadership folks who are excellent but aren't holding 50 percent of the equity, versus someone who used a co-founder dating site and was like, ‘yeah, we met three months ago, but it seems great.’”

This episode highlights a major shift in how early-stage founders seek guidance and build their companies. Founders are leaning more on peers, podcasts, and communities, crafting resourceful strategies to navigate the complexities of entrepreneurship in 2025. From rethinking team composition and leveraging AI to challenging traditional perceptions of "safe bets," today’s founders are rewriting the playbook.

If you’re wondering how to stretch your runway, structure your team, or survive the rollercoaster of building a company, this episode delivers actionable insights and fresh perspectives to help you succeed.

RUNTIME: 44:44

EPISODE BREAKDOWN

(2:19) A brief overview of Mercury and Mercury Raise.

(3:42) Mallory describes a day in the life of Mercury’s Community team.

(6:18) Do mature startups worry about the same things as seed-stage teams?

(8:41) “ We have a pretty good pulse on what people are talking about and what people are struggling with.”

(9:26) Nearly a quarter of all survey respondents applied to accelerators but were rejected.

(11:05) Why founders are more likely to get advice from this podcast than their VCs.

(13:39) “ The peer connection that founders have is almost trauma bonding.”

(15:02) “ We're seeing founders and investors giving the advice to be much more constrained in spend management.”

(17:43) Mallory describes different founder archetypes who are attracted to Mercury Raise.

(21:07) “ AI investments now are a lot more calculated than they were in the last couple of years.”

(24:45) For AI founders, building in a hype cycle “ can be simultaneously demoralizing and exciting.”

(27:17) How Mercury Raise creates value through community.

(29:54) Mercury’s Investor Connect program helps founders sharpen pitches.

(32:54) “Fundraising in general is just a black box.”

(36:13) Vibe check: “solo founders are actually becoming a little bit more common and a little bit more accepted.”

(37:19) ”Co-founder breakups — it's worse than the real thing.”

(38:02) Mallory’s advice for founders who are planning to fundraise in 2025.

LINKS

SUBSCRIBE

Thanks for listening!

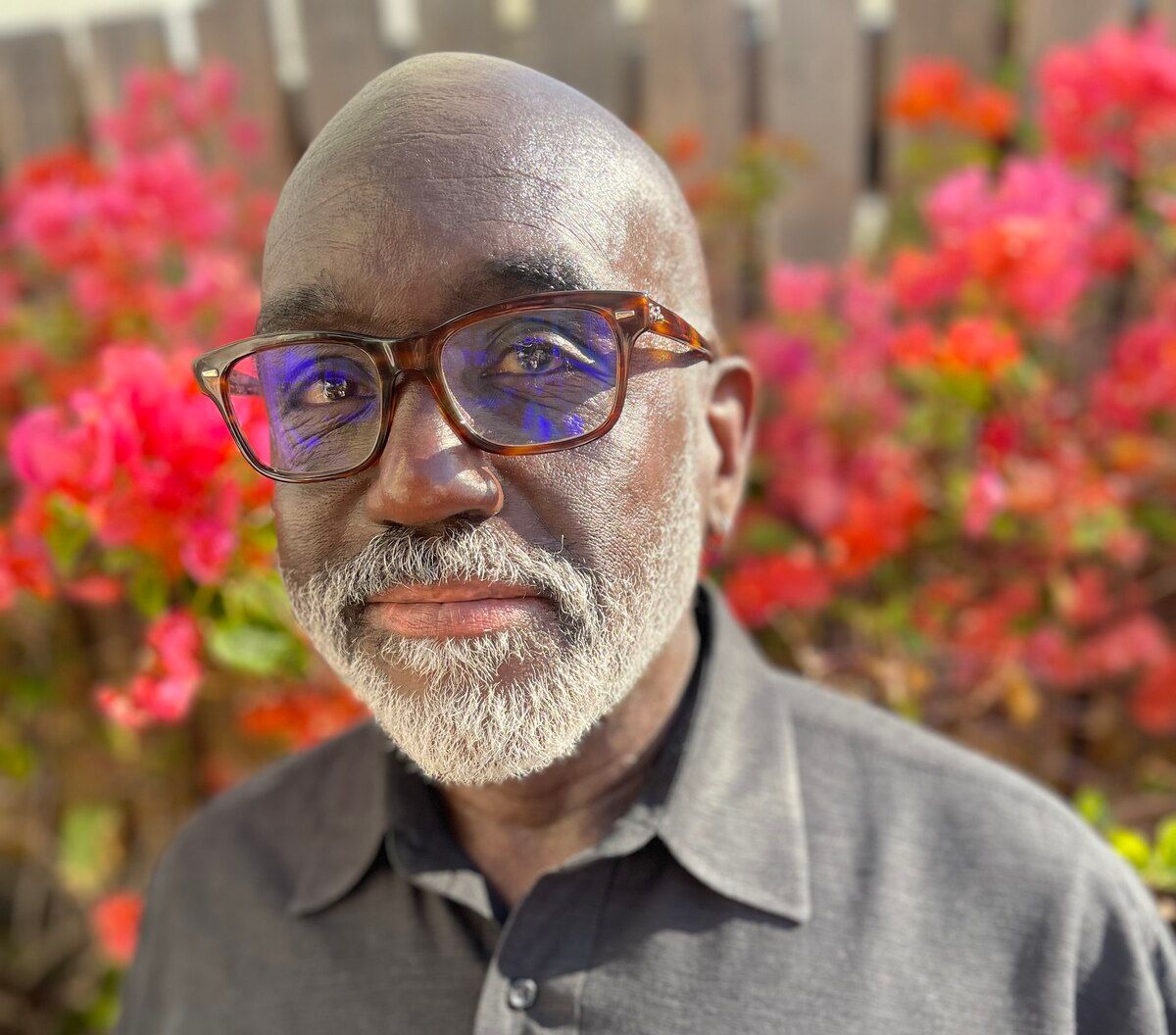

– Walter.