I grew up outside New York City, but I’ve lived in San Francisco for more than half my life. As a kid, I was used to harsh winters, but my West Coast wardrobe is light on all-weather gear.

Which is why, one February, I found myself in NYC helping a friend dig their car out of a snowbank to avoid a ticket. They were bundled up in a heavy coat, knit hat, and wool gloves. I had on jeans, a baseball cap, a thick sweater — and blue suede sneakers.

I remember the sneakers because they got soaked through, leaving blue smears in the snow as we worked.

The lesson? Not everything from California travels well.

That includes startup advice. What works in Silicon Valley doesn’t always work for founders in Africa. Like wearing Adidas in a snowstorm.

Some challenges overlap, but many don’t: currency volatility, limited early-stage funding, and investors who expect you to scale faster than the market allows.

So how do you grow beyond your home market? How do you raise funds when VC is scarce? And what do African founders need to do to make their startups venture-backable?

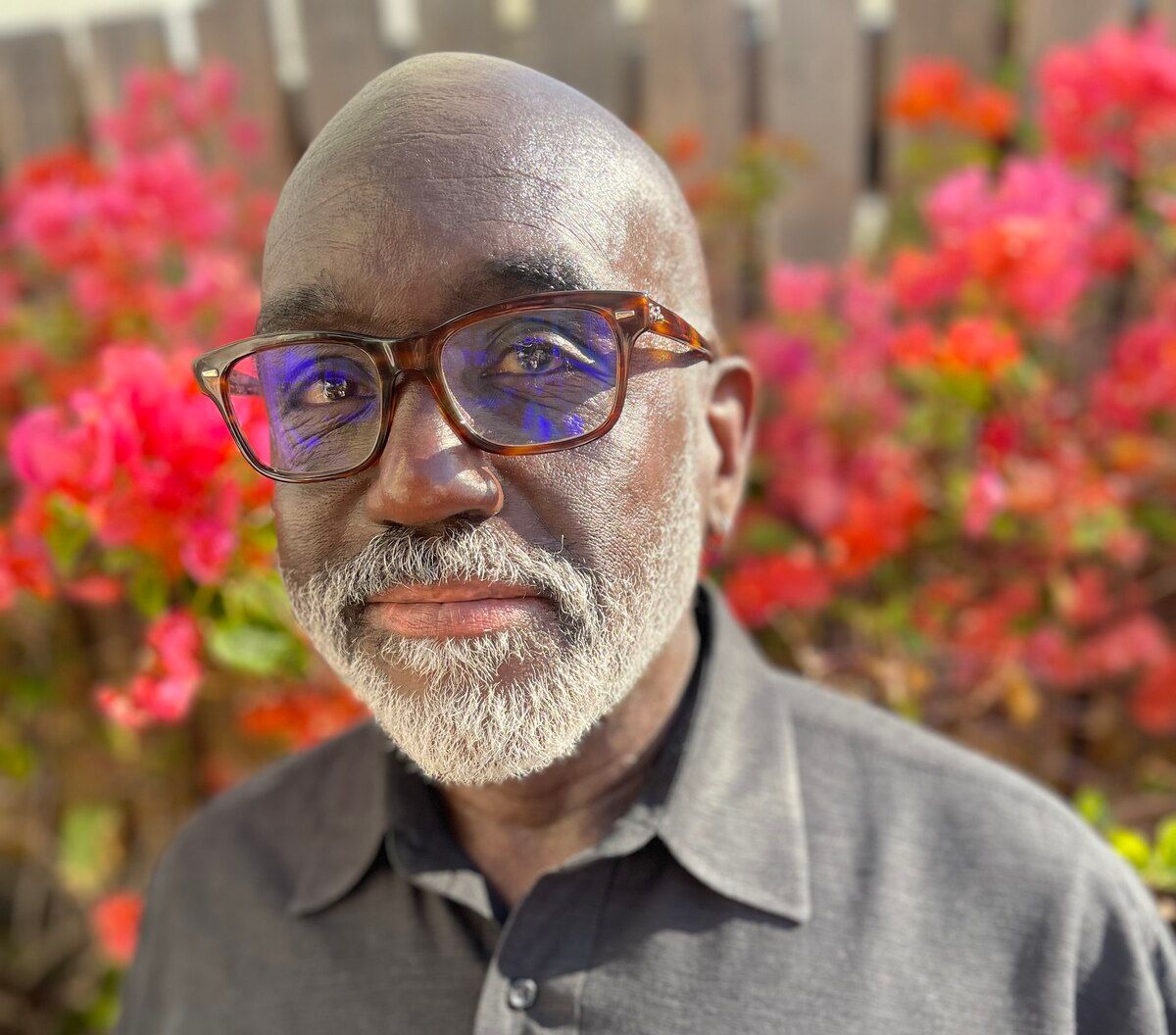

To find out, I spoke with Mobola da-Silva, a partner at Capria Ventures based in Nairobi, Kenya. She’s been investing in Africa and other emerging markets for nearly two decades and knows exactly what separates startups that thrive from those that stall.

“Silicon Valley looms larger than life in Africa,” she said, despite myriad differences that make it “not always the most useful sort of reference.” These include limited market size, currency fluctuations, a smaller VC pool, and other factors that require a different playbook.

“Founders now have a much better appreciation for these differences and build the businesses differently,” said Mobola.

In our interview, she shares practical insights on navigating currency risk, securing funding, and preparing for Series A, even if you don’t have a deep-pocketed network to lean on.

Listen in for the insights that could give your startup the edge.

RUNTIME 46:19

EPISODE BREAKDOWN

(2:03) How Mobola got her start in VC and the path that led her to Capria Ventures.

(4:09) Capria Ventures' investment thesis.

(5:32) The regions and sectors where generative AI is creating real value.

(10:41) The best way to pitch Capria Ventures — and what investors want to see.

(12:26) “A venture-backable business has to be able to achieve significant scale.”

(15:13) “We're getting a bit more creative in Africa around funding for startups.”

(16:20) How currency volatility impacts valuations — and strategies for mitigating risk.

(22:18) “To pitch successfully, you have to be able to tell a story, right?”

(23:51) Why Capria Ventures avoids solo founders and what investors look for in teams.

(28:33) “Many investors don't think of product-market fit as a binary thing.”

(31:29) The key metrics that signal true product-market fit.

(33:49) “Make sure that you have a strong business before you try to start to move it to another market.”

(37:49) “Silicon Valley looms larger than life in Africa.” How founders should interpret this influence.

(42:46) Mobola’s top advice for early-stage founders in Africa looking to scale and raise capital.

LINKS

SUBSCRIBE

Thanks for listening!

– Walter.