In the startups where I worked, we never had spare laptops.

When we hired someone, we’d order their laptop that day. That’s Startup Cashflow 101: don’t spend money until you have to.

The same principle applies to your leadership team. Hiring a CMO before product-market fit? Too soon. And a CEO can handle COO duties for a while. Most seed-stage companies don’t need a full-time Chief Financial Officer, either.

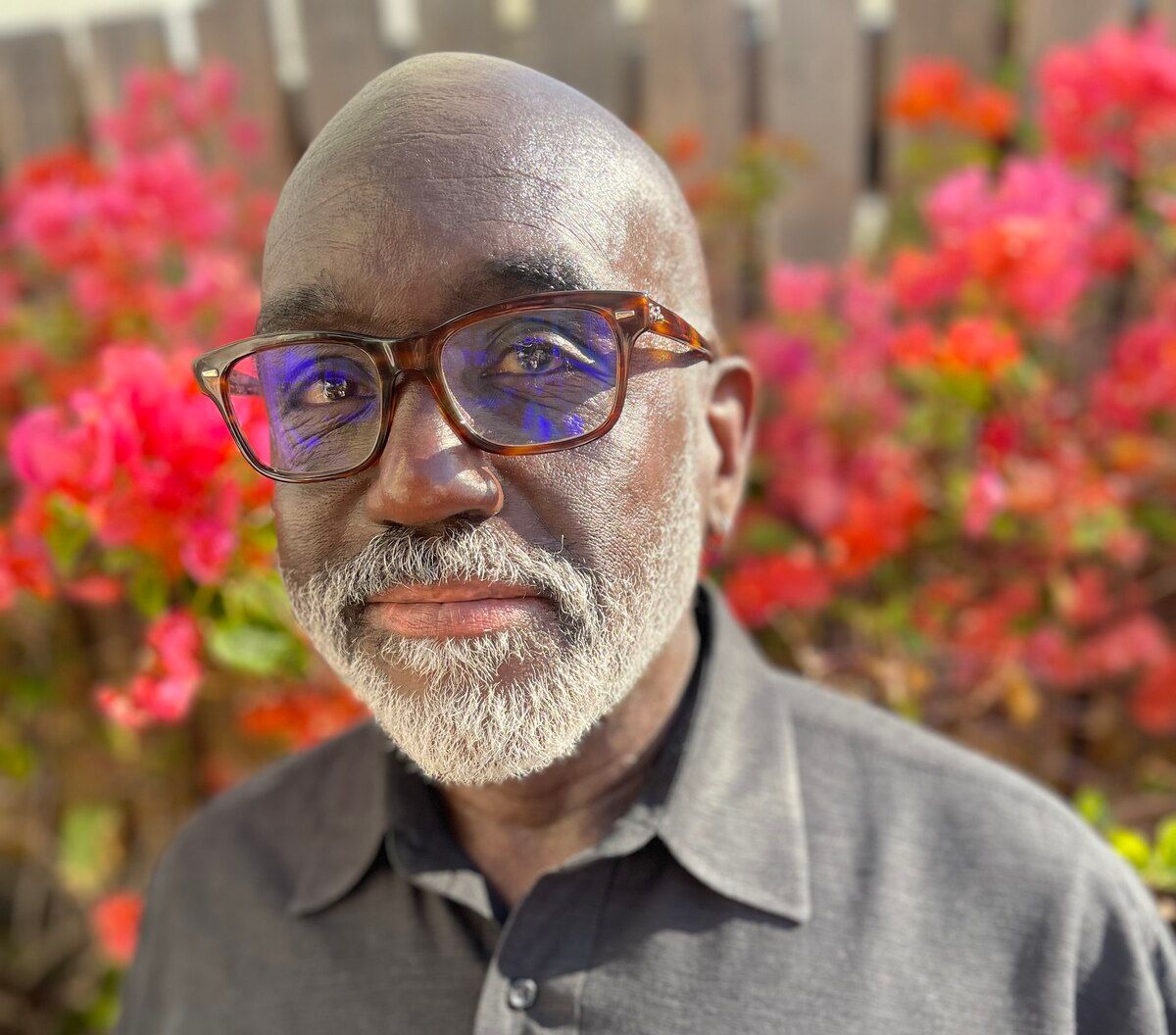

A good controller can handle day-to-day finances, while a fractional CFO can plan future fundraising and create investor-friendly forecasts — all without reducing your runway. To understand why a fractional CFO might be the smarter move, I spoke to Dan DeGolier, founder of Ascent CFO Solutions.

One of the biggest misconceptions among founders is not understanding the difference between a controller and a CFO, Dan explained.

“We might be [there] two days a week or three days a week. But we are very much a part of that team.”

A controller balances the books and ensures reports are accurate, while a CFO provides strategic guidance, helping founders navigate fundraising, build robust financial models, and make data-driven decisions that help them scale effectively.

“Until you've reached a pretty significant level of traction, that doesn't necessarily need to be a full-time role,” said Dan. “We might be [there] two days a week or three days a week. But we are very much a part of that team.”

About 40% of his clients are venture-backed startups that already have controllers or small financial teams on board. According to ZipRecruiter, startup CFOs in California make an average salary of $149K, but that relatively low take-home pay is often offset by a 1-5% equity grant. “CFOs come pretty with a pretty expensive full-time price tag,” he said.

Hiring a part-time financial wiz doesn’t just save money; it also adds intangible value to the organization, he added. “That CFO can be mentoring and overseeing that controller, who maybe is upwardly mobile and wants to grow into a CFO role. Eventually, the oversight that a fractional CFO can provide… will maybe increase retention, because that person doesn't see a ceiling on top of them.”

One of the most striking parts of our conversation was Dan’s description of the onboarding process. In the first 30 days after signing on, “we go really deep with that client,” he said. “We get our arms around all of their formation agreements, their cap table, all of their historical financials, what KPIs they're tracking today, everything how they're forecasting today.”

Once they “peel back all the layers of the onion,” Dan’s team uses those findings to build a new financial model that integrates historical data, key metrics, GTM strategy, pipeline, and other factors.

There’s a lot here to dig into: his suggestions for improving cash flow forecasting, why venture debt can be an appealing option to traditional VC, and why he thinks the traditional 18-24 month runway window is still a useful goal.

Runtime 27:21

Episode Breakdown

(1:44) Dan explains Ascent CFO Solution’s origin story.

(4:53) Why so many founders hire full-time CFOs before they actually need to.

(6:33) A list of specific value-adds a fractional CFO can provide.

(7:29) “We might be two days a week or three days a week. But we are very much a part of that team.”

(8:57) Inside Dan’s client onboarding process.

(12:44) “Part of it is getting a handle on cash flow and spend.”

(15:24) “Understanding what the risk factors are to your runway is really critical.”

(18:39) Which stats and KPIs are most important to share with the entire company?

(20:51) If you want your cash flow to break even, “be capital efficient to begin with.”

(23:31) Clients “often supplement a VC round with a venture debt round so they can extend that runway a little bit further.”

(25:09) How to interview a CFO if you don’t have an entrepreneurial background.

(26:08) Resources Dan recommends for founders seeking financial discipline.

Links

Blue Ocean Strategy: How to Create Uncontested Market Space and Make Competition Irrelevant, W. Chan Kim and Renee Mauborgne

Traction: Get a Grip on Your Business, Gino Wickman

Subscribe