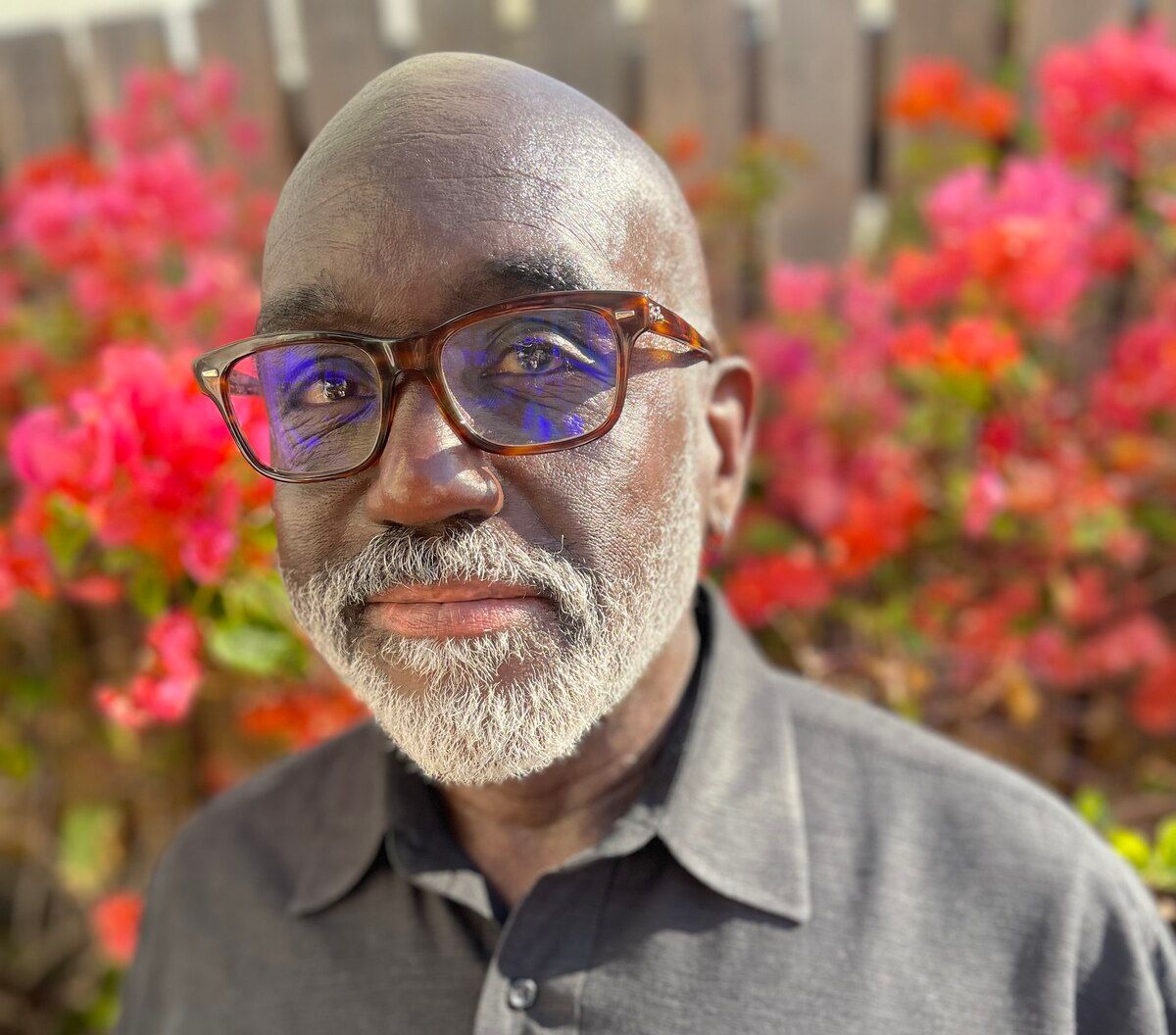

Payton Dobbs, partner, Hoxton Ventures

In most of the world, a profitable company that reaches an annual run rate of $3 million in year two would be considered a success.

Here in the Bay Area, a lot of people would still lump that into the “lifestyle business” category.

When I first heard the term, it felt smug — the same way some people bristle at “bridge and tunnel crowd” or “flyover states.” Me? I’d love to build a lifestyle business. (In fact, I’m doing that right now.)

Sustainable companies that will never become billion-dollar disruptors just aren’t interesting to tech investors. That’s not a judgment on the VC community, it just underscores how much wealth is sloshing around waiting to be deployed. Thanks to power-law dynamics, only potential unicorns need apply.

Not all good ideas are venture-scale, and this episode is about learning how to tell the difference.

I spoke to Hoxton Ventures Partner Payton Dobbs — who recently returned to the Bay Area after working in their London office — about the frameworks he uses to size up serviceable addressable markets. He also shared tactical advice for European founders planning to expand and hire in the US.

Below are the most tactical lessons worth bookmarking, sharing, and acting on.

YouTube

Apple Podcasts

Spotify

1. His North Star: creating new categories

Before he digs into product, he evaluates the category itself:

Is this a new market, not a repackaged one?

Does it pull budget from existing categories or create one consumers didn’t know they needed?

Is there a real, defensible value chain — and do you know where you sit inside it?

He’s not looking for a spreadsheet-perfect model at the pre-seed stage. But he does expect founders to explain where the money is, who controls it now, and why they have a right to take it.

Some categories start tiny but grow fast (example: food delivery pre-DoorDash). The question isn’t “Is this big today?” It’s “Does this become big if you’re right?”

2. Your deck shouldn’t just show TAM — it should show how you’ll reach it.

Payton sees too many decks with a generic multi-billion-dollar TAM claim, and nothing else.

His minimum bar:

Show your SAM (serviceable addressable market).

Segment it by geography, customer type, or buying motion.

Explain how the initial wedge expands into something larger.

For early founders: the bar is clarity, not certainty.

3. Technical founders don’t need to be commercial experts — but they must show curiosity.

Payton works with deeply technical founders all the time. The issue isn’t lack of GTM experience — it’s lack of diligence.

His baseline validation framework:

Learn the competitive landscape: Who failed? Who succeeded? Why?

Examine the dominant motion in your category (PLG, enterprise sales, freemium, etc.).

Form a point of view on how you’ll reach customers — even if that POV will evolve.

He’s not looking for a polished strategy. He’s looking for signs you’re doing the work.

4. Early pricing is not just about math.

Pricing is an art and a science, and Payton sees founders leaning too heavily on the science.

The tactical framework he shared:

The Science:

Market comps

Cost structure

Customer willingness to pay

The Art:

Brand positioning

Product experience

Emotional value

Category shift (e.g., Nest releasing thermostats worth 25× the legacy price)

The best companies earn a premium because they change the definition of the category, not because they race to the bottom.

5. The #1 mistake EU founders make when entering the US:

“If you build it, they will come” thinking.

America rewards companies that push, signal, and engage. Key friction points EU founders consistently underestimate:

US buyers evaluate differently and faster.

Competition is louder and more aggressive.

Hiring requires interviewing for drive, not just competence.

Go-to-market motions may not translate directly from home markets.

His advice: Don’t reinvent your entire company — but do reboot your customer discovery process.

6. If you’re expanding to the US, this is your new playbook.

Payton laid out a clear, tactical sequence:

Replicate the early spark: Validate that the buying behavior you saw at home exists here.

Feel the competitive pressure: US incumbents and challengers operate differently — expect speed and noise.

Build outward-facing roles first: Marketing, sales, partnerships, and (yes) PR.

Leave engineering in Europe: It’s cost-efficient, high-quality, and better for runway.

Expect to do more storytelling: Americans sell harder — and sell themselves harder.

The goal isn’t to Americanize your product, its to localize your GTM motion.

7. How to hire your first US employee (and not get burned).

Founders should interview for:

Role competence (skills)

Cognitive ability (speed of learning)

Cultural traits tied to startup success:

Bias toward action

Comfort with ambiguity

Willingness to “roll up their sleeves”

European founders often underestimate how performative we American candidates can be! The fix is structured interviewing around real behaviors, not charisma.

8. Go beyond metrics and identify your leading indicators.

Payton stressed that dashboards often show yesterday’s weather. Founders need forward-looking signals like:

Engagement intensity predicting subscription renewal

Early retention patterns predicting LTV

Activity metrics that precede upsells

Backward-looking metrics are for reporting. Forward-looking metrics are for survival.

9. Pricing, TAM, GTM, sales ops — none of it matters without this one thing.

Payton returned to this repeatedly: Founders must want to build something big.

Not because big is inherently better, but because ambition shapes culture, pace, hiring, pricing, category creation, and how long people stick around when it gets hard.

10. How to actually get a meeting with Hoxton Ventures.

Hoxton Ventures gets hundreds of decks a week, but his advice was refreshingly simple:

A warm intro beats everything.

Show that you’ve researched why Hoxton, and why this partner.

Have a clear POV on category and customer, even if it’s imperfect.

Being early is fine. Being vague is not.

Email exists, LinkedIn exists, but if you can get someone else to vouch for you, it’s a strong signal.

If you found this helpful…

This was my first true video episode. It took a minute to figure out the workflow, the nonsense Descript threw at me — all of it. If you want to keep seeing this kind of work, here are three things that help a ton:

1. Subscribe to Fund/Build/Scale on Beehiiv

I moved everything off Substack so I can centralize here.

2. Share this episode with one founder who needs it

You know the one.

3. If you’re feeling generous…

Become a paid supporter. It directly buys me time to make more deeply reported conversations like this one.

Thanks for reading,

— Walter.

RUNTIME 1:00:46

EPISODE BREAKDOWN

02:12: Payton Dobbs’ background and the value of building presence in key markets

03:25: Not all good ideas are venture scale: how to assess billion-dollar potential

04:01: Why new category creation is crucial for venture scale startups

06:35: What VCs look for in a pitch deck: TAM, SAM, and logic behind the numbers

08:06: Case study: Deliveroo and building new markets from small segments

09:07: Identifying pain points and leveraging founder expertise

10:57: Advice for technical founders: the value of complementary co-founders and commercial skills

12:23: Building frameworks: due diligence on markets, competitors, and learning from others’ mistakes

13:54: Adapting go-to-market strategies for different business models (B2B SaaS, consumer, etc.)

15:00: The importance of having a perspective and being able to debate your point of view

15:50: Solo founders vs. teams: most are teams, but solo founders can succeed too

13:28: The state of the AI ecosystem in Europe and why it’s accelerating

17:18: Navigating US immigration and talent: why keeping dev teams in Europe can be strategic

20:34: Common mistakes when entering the US: “If you build it, they will not come”

21:21: Do you need to reboot customer discovery in new markets? Sometimes, but not always

22:24: The importance of understanding the competitive landscape and customer needs in each market

24:54: Hiring in the US: cultural differences and what to look for in team members

27:33: Payton’s parting advice for founders expanding to the US: grind, network, and be relentless

28:36: Building sales ops from scratch: tools, systems, and process before people

32:05: Understanding and accruing value in the business value chain

34:45: Signals that a team can move from tech to traction: agility, speed, and adaptability

36:37: Pricing as an art and a science; lessons from Nest and Apple

40:00: Metrics: NPS, customer surveys, and forward-looking indicators

44:42: What Payton hopes to unlock for founders by being based in the US

LINKS

White paper: Europe’s Sputnik Moment

NVIDIA partnership: Accelerating the UK’s AI Startup Ecosystem