If I didn’t follow Allie Garfinkle’s “Term Sheet” newsletter at Fortune, I probably wouldn’t have recorded this episode.

On October 29, she broke the news that MaC Venture Capital had raised $150 million for its third fund since 2020.

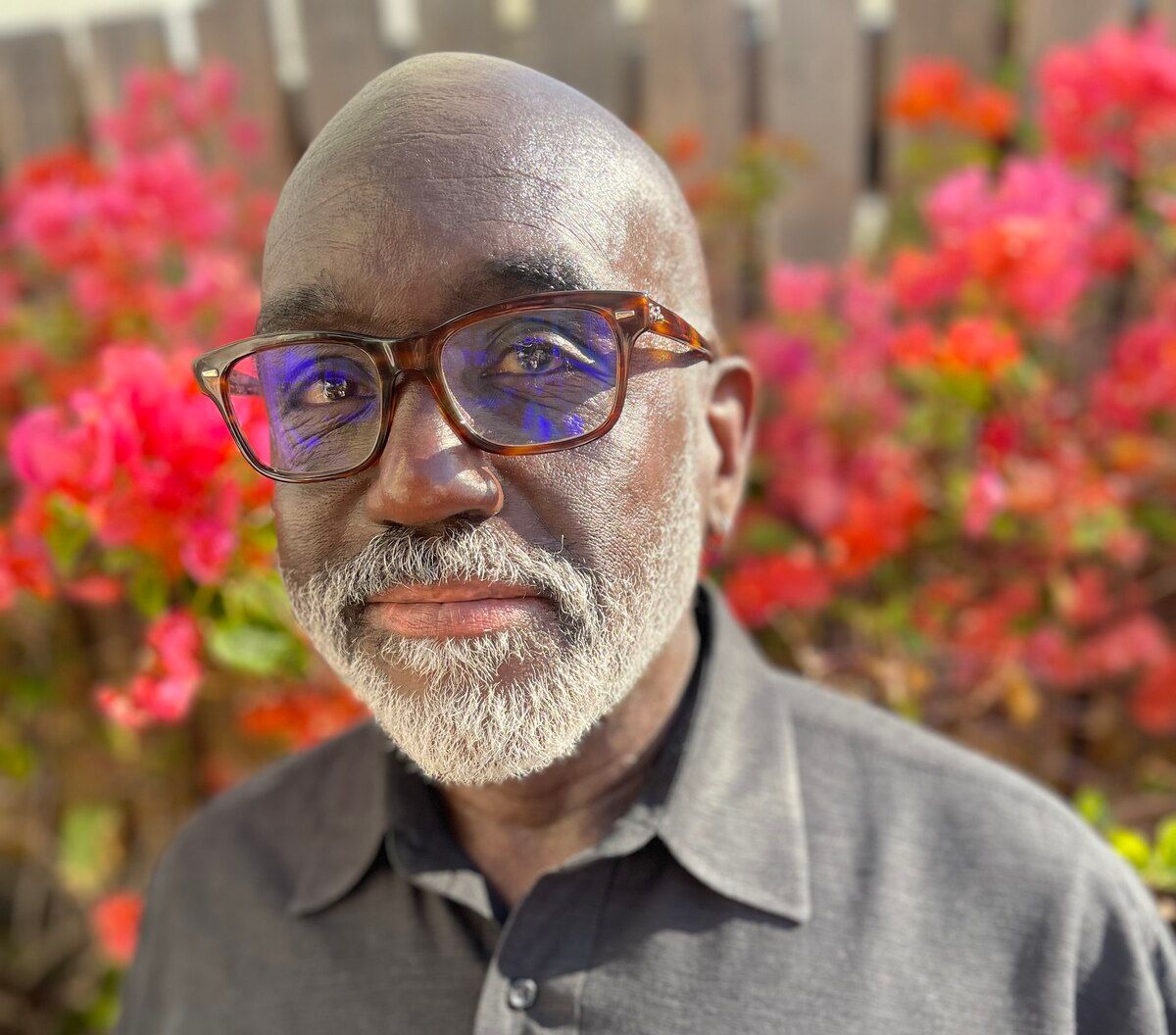

Because Co-founder and Managing General Partner Marlon Nichols has a unique take on how to identify and back diverse founders, I wanted to learn more. I reached out to his office for an interview that week, and we recorded this conversation on November 18.

Marlon previously co-founded Cross Culture Ventures, which merged with M Ventures in 2019 to form MaC VC with former talent agent Mike Palank, the firm’s general partner, and former Washington, D.C. mayor Adrian Fenty, founding managing partner. The merger combined Cross Culture Ventures’ expertise in cultural investing with M Ventures’ resources, forming a firm uniquely positioned to spot emerging trends and back diverse founders.

In this episode, Marlon and I talked about his path from enterprise software into venture capital and MaC VC’s focus on founders from non-traditional backgrounds. He also explained what types of startups the new fund is open to and discussed some of the criteria he uses to assess teams (and their ideas) before sharing recommended fundraising strategies.

Early in our conversation, I asked about the cultural investing concept he developed that underpins the firm’s thesis.

“We look for evidence of human behavior that suggests that a certain sector, a certain industry, a certain activity is going to be meaningful in years to come,” said Marlon. “And we find companies that are building in those sectors and in alignment with where we see the world going.”

As a seed-stage generalist fund, MaC Venture Capital invests in teams that have built a product and are either launching or have recently taken it to market. Looking ahead to 2025, he said, “areas we know very well” include fintech, media entertainment platforms, healthcare, logistics, aerospace and defense, and “some deep tech.”

With the new fund, MaC VC plans to write larger checks, going from an average of $1.5 million to $2-3 million. “In this game, ownership is king,” Marlon said, noting that their target is “somewhere between 10 and 15% ownership at the time that we write our initial check.”

Although the firm is based in LA, its formation documents promise investors that 10% of its deals will be out of strategy or international. “So far, international has meant Mexico City, Canada, one in the UK, and about a couple handfuls of companies in Kenya and Nigeria,” he said. Although MaC VC is actively looking for more deals in Africa, he said currency fluctuations make B2B plays look more resilient than B2C.

“You can charge your clients in USD or the pound or something else that's a more stable international currency,” said Marlon. “While this is going on, it makes it very hard for us to invest in a Africa-based company that is selling to Africans, because you can't ask them to pay in USD.”

We closed out the conversation with topics relevant to teams hoping to raise funds this winter. Those who present strong technical skills and founder-market fit are at the top of his holiday wish list; solo founders who have shiny pitch decks are likely to find a lump of coal in their stocking, he predicted.

“ If you're betting on an AI company, there better be an AI engineer on the team, or at least some form of data scientist,” said Marlon. “If you're using someone else's models, but you're feeding data into that model, one of those two things has to be true. Otherwise you're just setting yourself up for failure.”

Runtime 45:44

Episode breakdown

(2:44) “ My career has been in three parts.”

(8:31) “ Where are people spending their time and their energy today, and where will they spend it tomorrow?”

(10:50) “ Our team takes it very seriously to evaluate everything that comes in and is shared with us.”

(12:19) MaC Venture Capital’s plans for its new $150M fund.

(16:21) “ In this game, ownership is king, right?”

(21:19) How Marlon identifies founders from non-traditional backgrounds.

(23:56) “ In the founding team itself, what we're looking for are three main things.”

(27:46) Why founder-market fit is so critical at seed stage.

(29:42) Advice for founders who are getting ready to start fundraising.

(34:21) What to do if you can’t raise a family & friends round.

(41:50) Some traits founders should seek out in seed-stage investors.

Links

Subscribe